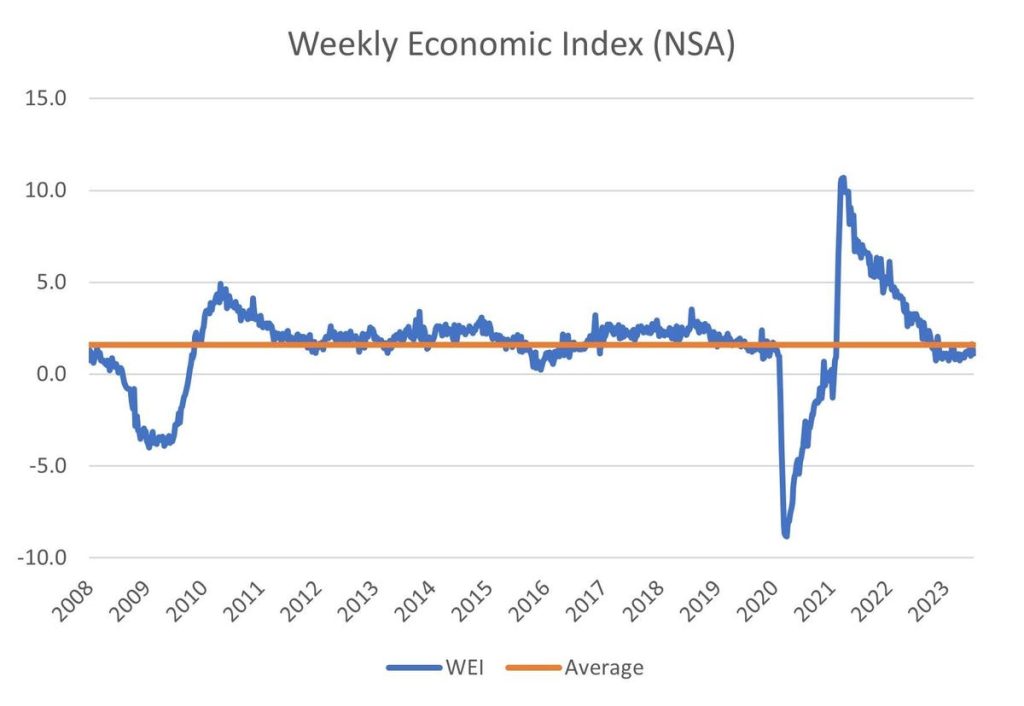

The New York Federal Reserve produces a Weekly Economic Index which follows changes in a large number of important economic data series. It’s not a GDP measure, but an index of ten daily and weekly indicators of real economic activity, scaled to align with the four-quarter GDP growth rate. The average of the Index since 2008 is 1.6% (orange line in Chart 1). The 2008-2009 financial crisis and the 2021-2022 Covid periods are clearly traced out by the Index. The negatives from the intentional closing of the economy due to Covid have been reversed and the economy seems to have stabilized, although below the average value of the Weekly Economic Index.

The Weekly Index was above average from 2017 to 2019 prior to the Covid recession. Similarly, NFIB’s Index of Small Business Optimism (Chart 2) ran well below the historical average until 2017 when it surged to record high levels before the Covid shutdown. The Index rose from 95 in November 2016 to a record 108 four months later. It remained at historically high levels until February 2020 when the Index collapsed, falling from 106.7 to 99.4 in March 2020. From there, the Index faded to a recent low of 87.5 in December 2022, then meandered higher, most recently closing at 90.6, well below the historical average from 1973 to date of 98.

Looking ahead, the NFIB data anticipate a slowing economy. How slow is less clear. A soft landing seems unlikely as the Fed is committed to getting inflation down to 2% and this will have to be accomplished while fiscal policy remains expansive, resisting the slowdown needed to reduce prices, compelling the Fed to be tighter. Deficits in the federal budget will grow, raising pressure to raise taxes and cut spending, difficult with stand-off divisions in the Congress. As the deficit grows, the interest cost associated with $33 trillion in Federal debt will put a squeeze on government spending on other priorities. A lot of moving parts, the outcomes uncertain. Small business owners will continue to deal with the rising costs of regulations, energy and labor while taking care of the continuing flow of consumers at their firms (hoping it lasts).

Read the full article here