General Motors, after pouring billions of dollars into its Cruise robotaxi unit over the past eight years, said it’s ending the subsidiary’s stand-alone efforts and will combine it with in-house efforts to develop autonomous driving technologies for personal vehicles.

The Detroit-based automaker said it will no longer fund Cruise’s robotaxi work as it will take too long and cost too much to scale the business to compete with competitors it didn’t identify. Presumably, its biggest challenge is catching up with Waymo, which is carrying hundreds of thousands of riders in its robotaxis every week and is about to expand the service to Miami, Austin and Atlanta.

“This is the latest in a series of decisions that GM has announced that underscore our focus on having the right technology for the future of our company and the industry,” Mary Barra, GM’s chair and CEO, said on a conference call. “GM made this decision to refocus our strategy because we believe in the importance of driver assistance and autonomous driving technology in our vehicles.”

“Cruise has been an early innovator in autonomy, and the deeper integration of our teams, paired with GM’s strong brands, scale, and manufacturing strength, will help advance our vision for the future of transportation.”

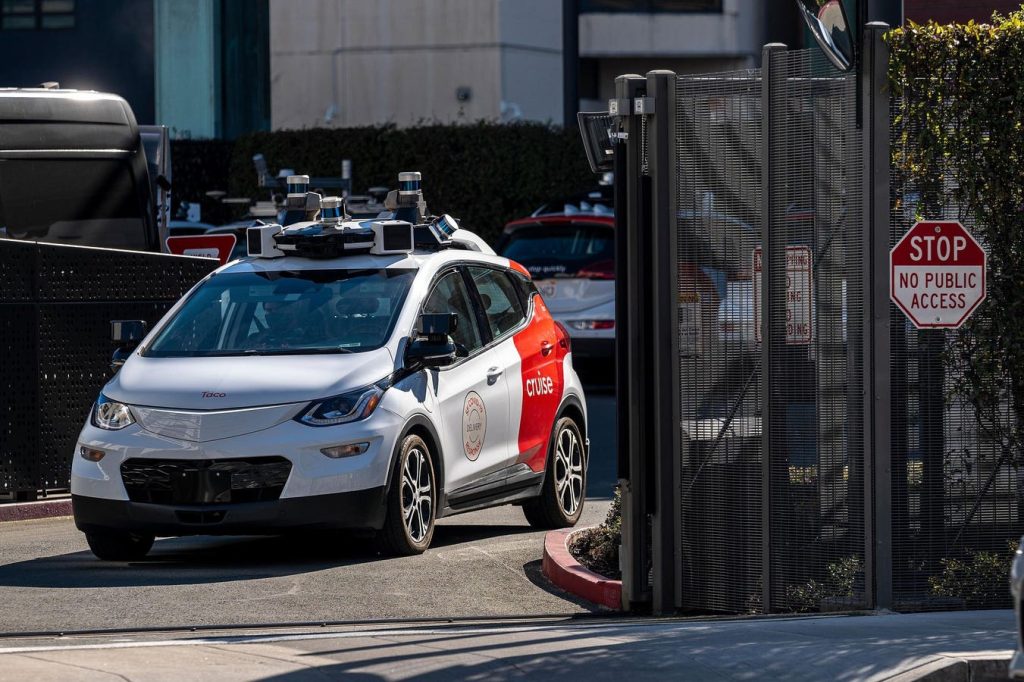

Cruise, acquired by GM in 2016, was among the best-funded robotaxi companies, raising more than $8 billion, including investments from SoftBank and Honda. For years it was locked in a tight competition with Alphabet’s Waymo to be a dominant player in the emerging autonomous vehicle space. However the company struggled to regain its footing after an October 2023 accident when one of its robotaxis struck and dragged a woman in San Francisco, shortly after the company had opened up the robotic ride service to the public. Cruise recently announced plans to work with Uber and was focused on rebuilding trust in the brand, but those efforts were not seen as sufficient by GM’s management.

The move is reminiscent of a 2022 decision by Ford and Volkswagen to shut down Argo AI, their joint-venture autonomous driving unit, which like Cruise had also raised billions from the automakers. Ford CEO Jim Farley at the time also said funding a robotaxi startup was too costly and would take too much time. Uber, which now partners with Waymo in some cities, shut down its efforts to develop robotaxis in 2020, months after a fatal accident in which one of its test vehicles killed a pedestrian in suburban Phoenix.

Barra made no mention of the Cruise accident, instead focusing on the need for GM to use its funds more efficiently. “Given the considerable time and expense required to scale a robotaxi business in an increasingly competitive market, combining forces would be more efficient and therefore consistent with our capital allocation priorities,” she said.

Though Tesla’s Elon Musk has set a goal for his company to be a leader in robotaxi technology, it hasn’t yet demonstrated the ability to achieve that, at least not in the near term. Instead, Waymo appears to be in a unique position of being the only large-scale player in the robotaxi space. The company last month said it’s carrying more than 150,000 paying customers in Phoenix, San Francisco and Los Angeles, a number that will likely jump dramatically next year as it enters new cities and expands its vehicle fleet. So far, it’s also managed to avoid any serious accidents that could slow its growth plans.

Amazon’s Zoox unit, which is preparing to launch a robotaxi service in Las Vegas, for now appears to be one of Waymo’s few U.S. competitors though its scale is much smaller.

GM owns about 90% of Cruise and will acquire the remaining shares in it from other investors after receiving approval from the Cruise board. It expects to save more than $1 billion a year after completing the restructuring plan next year.

Barra didn’t say exactly how many Cruise employees would be moved over to GM during the conference call.

More From Forbes

Read the full article here