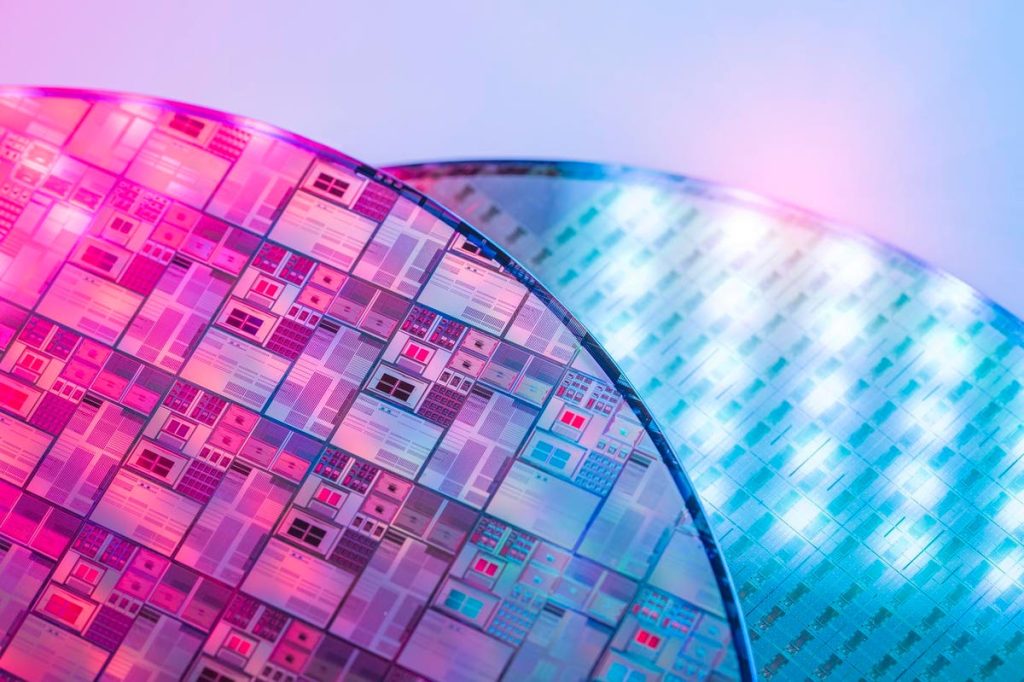

SEMI reported that global semiconductor equipment billings increased 9% year-over-year to $26.8B in the first quarter of 2023, while quarter-over-quarter billings slipped 3%. Billings grew in North America and Europe QoQ while declining in Asia and the rest of the world. This likely reflects the impacts of the US and European CHIPS Acts and new funding for semiconductor fabs. The details are shown below from the June 6, 2023 SEMI press release.

In mid-May SEMI said that they expected that the second quarter of 2023 would be a likely low point in semiconductor equipment sales with a slow recovery to begin in the year’s second half. Note that semiconductor equipment sales to support growth in semiconductor production is a leading indicator of anticipated chip demand since it takes multiple quarters for production and installation of large semiconductor equipment.

At the beginning of June DIGITIMES projected that global foundry revenue will drop by 9.2% in 2023 to $1.280T (down from an earlier projection of $1.345T. Foundry revenue was estimated at $1.410T in 2022 (up 29.3% from 2021). The article attributed the drop to lower semiconductor sales due to a plunge in consumer electronics sales post COVIC, global inflation and geopolitical tensions.

Although AI chip demand and shortages of GPUs are boosting the high-performance Computing (HPC) market the overall demand for chips is down due to continuing customer inventory reductions and a slowing global economy. Furthermore, DIGITIMES says that although the electronics supply chain is expected to return to balance in the second half of 2023, preparation renewed growth in production appears to be less than usual for this time of year.

A report from Trendforce in late May said that 1Q23 DRAM worldwide revenue declined by 21% QoQ to $9.7B, the third consecutive quarter of DRAM revenue declines. Only Micron experienced an increase in shipment volumes in the quarter and an increase in market share although the three major suppliers (Samsung, Micron and SK hynix) experienced a drop in DRAM average sales prices (ASPs).

The article says that major suppliers are planning production cuts although 2Q23 forecasts suggest a rise in shipments. 2Q23 capacity utilization rates are expected to fall to 77% for Samsung, 74% for Micron and 82% for SK hynix.

These DRAM results are similar to those for NAND flash over the last year.

It is in light of these latest projections for semiconductor equipment investments and memory declines that we should consider the continuing rumors of Kioxia and Western Digital merging their NAND flash businesses. A recent article from Kyodo News pointed out that both company’s earnings are under pressure due to a plunge in demand for NAND flash memory chips (particularly for consumer devices).

If this merger were to occur it would mark continuing consolidation in the NAND flash business after SK hynix agreed to acquire Intel’s NAND flash memory business by 2025. As pointed out in a blog last January, Toshiba would probably benefit more than WDC in a merger of the two company’s NAND flash businesses. Toshiba owns about 40% of Kioxia and a merger of Kioxia with WDC might help Toshiba straighten out its continuing business problems. The article said that information on continuing discussion on a possible merger was from people familiar with the matter.

Time will tell if WDC and Kioxia will merge their NAND flash businesses. A continued downturn in the industry might make this more likely as WDC would have an opportunity to unload a non-profitable part of their business. However, what has gone down, will go up again, driven by long term requirements for digital storage of all types to fuel technology driven economic growth. This recovery could occur by the end of 2023 or in early 2024, with a full recovery, higher ASPs and profitability back by the second half of 2024 if not sooner.

SEMI reports a 9% YoY decline in semiconductor equipment billings in 1Q23. DIGITIMES projected a 9.2% decline in global foundry revenue in 2023. Major memory suppliers are planning production cuts. In light of demand and revenue declines rumors of a possible Kioxia and WDC NAND flash merger continue, although a return to growing memory demand by the end of this year and the beginning of next year could reduce pressure for such a merger.

Read the full article here